unified estate and gift tax credit 2020

Gifts have been taxed since 1924 and in 1976 Congress enacted the generation-skipping transfer GST tax and linked all three taxes into a unified estate and gift tax. Insolvency Professional And Its Role Under Ibc 2016 Insolvency Limited Liability Partnership Company Secretary Polis Signs 270 Million Small Business Loan And Grant Programs Into Law Denver Busin Small Business Loans Small Business Development Center Business Journal.

The unified estate and gift tax credit exempts people with taxable estates under 117 million from paying any estate taxes at all.

. As of 2021 married couples can exempt 234 million. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The Internal Revenue Service announced today the official estate and.

Your gifts can total 30000 for the year if you want to give two people each the annual exclusion amount. Gifts made each year in excess of the 16000 annual limit per recipient reduce your federal giftestate tax exemption when you die. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million.

The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. Unified estate and gift tax credit 2020 Tuesday March 15 2022 Edit.

The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. Then there is the exemption for gifts and estate taxes.

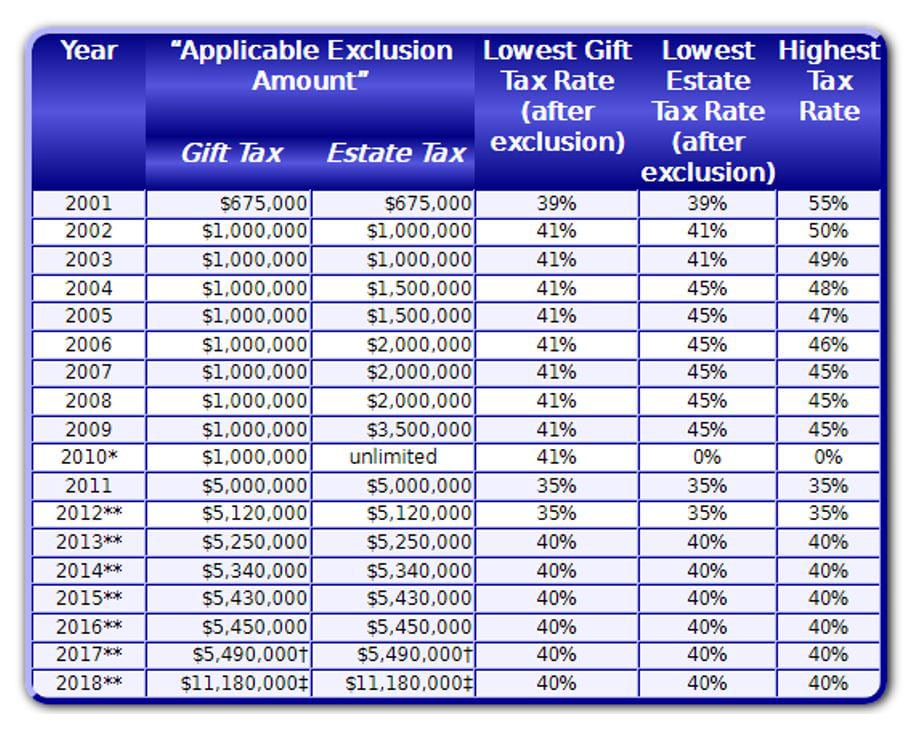

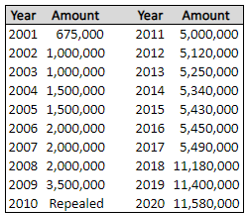

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of. A problem occurred. For 2021 that lifetime exemption amount is 117 million.

It consists of an accounting of everything you own or have certain interests in at the date of death. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. Instead these gifts are limited to 15000 per person annually.

The estate tax is a tax on your right to transfer property at your death. In 2022 couples can exempt 2412 million. Gift and Estate Tax Exemptions The Unified Credit.

Not over 2600 10 of taxable income. If a gift is given as a present interest gift meaning it is given outright to a person then the amount is not added into your total lifetime unified gift and estate tax credit. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due.

The unified tax credit is designed to decrease the tax bill of the individual or estate. Gifts and estate transfers that exceed 1206 million are subject to tax. Gift Tax Credit Equivalent 2141800 4417800 4505800 4577800.

The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. Students whove seen this question also like. A key component of this exclusion is the basic exclusion amount BEA.

You can give up to this amount in money or property to any individual per year without incurring a gift tax. Try refreshing the page. The gift and estate tax exemptions typically enable wealth to be passed on from one generation to the next tax-free.

Estate and Gift Taxes. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. Find some of the more common questions dealing with basic estate tax issues.

The previous limit for 2020 was 1158 million. If you were married your spouse also a US. For 2009 tax returns every American received an automatic unified tax credit against federal estate and gift taxes of 1455800 which is equivalent to transferring 35 million tax-free to your heirs.

For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax. For 2021 the estate and gift tax exemption stands at 117 million per person. Learn about the COVID-19 relief provisions for Estate Gift.

For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021. Income Tax Fundamentals 2020. This is called the unified credit.

That number is used to calculate the size of the credit against estate tax. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. The unified credit is per person but a married couple can combine their exemptions.

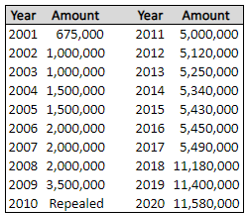

Individuals who are concerned their wealth may surpass any future unified tax credit should consider additional estate planning strategies to lock in the 117 million exemption. Citizen received the same exemption credit so that you could as a couple give a full 7. Estate Planning Strategies For Reducing Estate Taxes.

The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law applies the estate tax to any. The estate and gift tax exemption for 2021 is 117 million. The United States has taxed the estates of decedents since 1916.

For instance lets say you give your grandson a gift of 25000 in 2022. Any tax due is determined after applying a credit based on an applicable exclusion amount. The first 16000 is not taxable because of the annual exclusion.

The IRS places restrictions on gifts given to people other than your spouse. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000. The generation-skipping transfer tax is an additional tax on a transfer of property that skips a generation.

Should the exemption be set higher.

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Gift Tax Exclusion Essential Info Understand The Unified Credit

History Of The Unified Tax Credit Apple Growth Partners

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Understanding Qualified Domestic Trusts And Portability

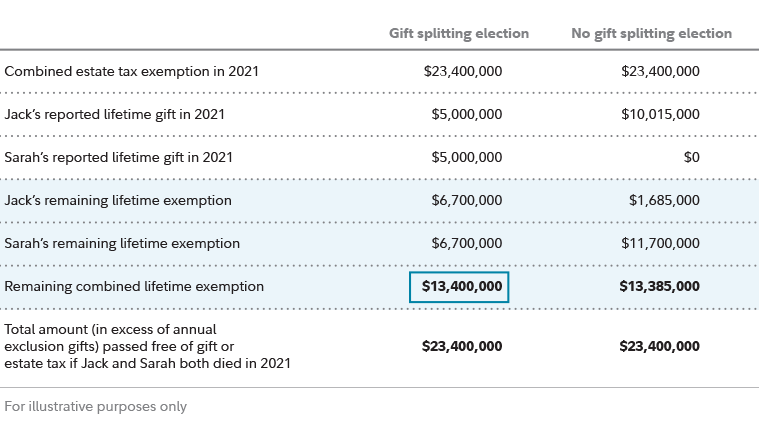

Estate Planning Strategies For Gift Splitting Fidelity

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

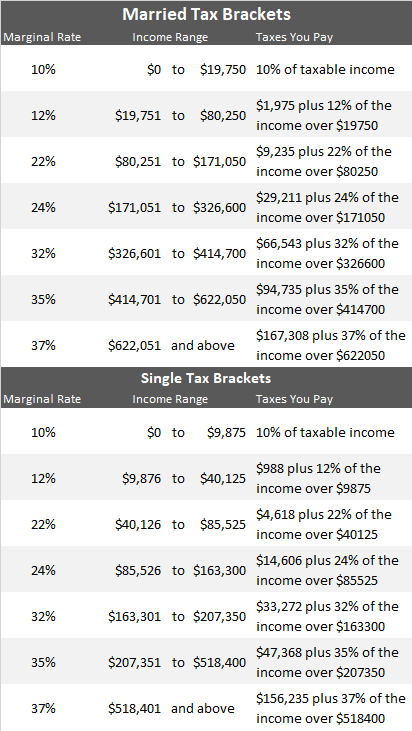

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc